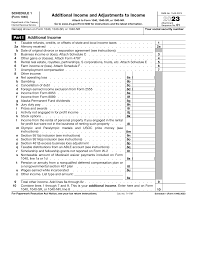

Federal Tax Forms 2024 Schedule 1 – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . Tax season is an important and stressful time of year. It’s when individuals and businesses gather their financial information and file their state or federal income tax returns with the .

Federal Tax Forms 2024 Schedule 1

Source : www.wate.comFederal Tax Filing Deadlines for 2024 420 CPA

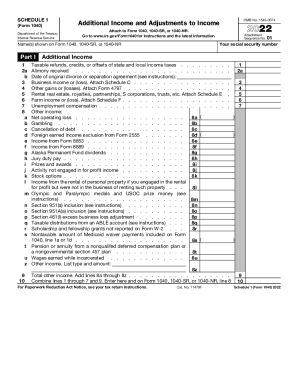

Source : 420cpa.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comPublication 505 (2023), Tax Withholding and Estimated Tax

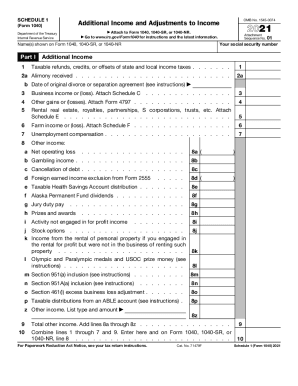

Source : www.irs.govIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comIRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com2023 2024 Application for Special Circumstance Consideration

Source : www.missouristate.eduFederal Tax Forms 2024 Schedule 1 IRS Releases Updated Schedule 1 Tax Form and Instructions for 2023 : Sometimes, you can deviate from the set estimated tax payments schedule Mar. 1, 2024, you don’t need to make any estimated payments. To calculate your estimated tax payments, use Form 1040 . For federal and state returns it also supports more IRS forms than competitors. Most tax preparation companies only allow you to file an IRS Schedule 1 on their free software versions. .

]]>